Overall Market Potential

All dollar amounts are in US dollars($).

Combined new engine sales per year worldwide, for the Marine, Aviation Piston Engine, Medium-Heavy Duty Cycle (MHDC) Truck classes 7 and 8 and Power Generator (gensets) and Non-Automotive markets are valued at about $68.8 billion.

These markets have five niches with eight distinct clienteles (Marine Outboard, General Aviation “GA”, first and second tier Light and Sport Aviation “LSA”, Unmanned Aerial Vehicles “UAV”, MHDC Engine sales, Power Generators and Non-Automotive).

| Market Applications | Value2 (US$) | Engines Sold3 | TOTAL2 | ||

|---|---|---|---|---|---|

| Marine | $11,000 | >1,000,000 | $188,792,500,000 | ||

| Aviation | GA (Aircraft) | New | $162.5 | 2,500 | |

| Repower1 | $5,525 | 85,000 | |||

| GA (Helicopters) | New | $165 | 1,100 | ||

| Repower1 | $2,100 | 14,000 | |||

| LSA | Tier 1 | $180 | 10,000 | ||

| Tier 2 | $20 | 6,000 | |||

| UAV | $100 | >250 | |||

| MHDC trucks | Hybrid Powerplants | New1 | $18,500 | 185,000 | |

| Hybrid Powerplants | Repower | $10,000 | 100,000 | ||

| Power Generators | $18,540 | >1,000,000 | |||

| Non-Automotive | $2,500 | 1,000,000 | |||

| Motorcycles | $120,000 | >128,000,000 | |||

1. 50% of market total. 2. in $ million US dollars per year. 3. units sold per year.

Marine Markets

The total worldwide marine engine market is estimated to reach $11 billion in annual retail sales by 2020.

The total worldwide marine engine market is estimated to reach $11 billion in annual retail sales by 2020.

The total worldwide marine outboard engine industry has a volume of sales of about 800,000 engines per year, which has remained fairly constant over the last seventeen years. The total worldwide marine outboard engine market reached about $4 billion in annual retail sales in 2013. About 250,000 marine outboard engines are sold per year in the US market, which commands a minimum of $2.2 billion in annual retail sales.

The outboard marine engine market is the segment in most desperate need of a new engine solution, which has been long overdue. This segment of the marine engine market, is our “shotgun target”.

In addition to the worldwide sale of new engines, we may, at a later time, also seize the market for used engines. We can market used and rebuilt Gryphon Diesel engines to customers who cannot afford to buy a new one. Capitalizing on this market has the potential to create great engine exchanges or trade-ups for local dealers in the medium and long-term future and establish a very long-term, loyal customer base. Gasoline outboard engines are hardly ever refurbished for sale, so competition would be minimal or even non-existent.

80% of marine outboard engine sales worldwide are around 90 HP engines, and in the US, 55% of the sales are around engines with 150 HP or higher. These are the portions of the market with the highest volume of sales, and since our 3-cylinder engine design has a range of 75 HP-350 HP, we can seize these markets with only one engine block, unlike any other competitor.

Aviation Markets

Market for new aviation piston engines totals about 3,600 engines sold per year with a value of about $627.5 million US.

New engine sales for the repower market can top 99,000 engines per year with the value of about $7.6 billion US.

General Aviation (GA) Market Potential

The GA new aircraft piston engine market has a potential of about 2,500 new 200+ HP engine sales per year in the US alone, and has experienced an additional sale of 1,000 repower engines, which is valued at $225 million per year. The average retail cost of a new 200 HP FAA-certified engine is about $65,000.

The GA new aircraft piston engine market has a potential of about 2,500 new 200+ HP engine sales per year in the US alone, and has experienced an additional sale of 1,000 repower engines, which is valued at $225 million per year. The average retail cost of a new 200 HP FAA-certified engine is about $65,000.

The recent FAA mandate stipulates that TEL [tetraethyl lead – (CH3CH2)4Pb] must be removed from AvGas starting January 1, 2017. TEL is a necessary component in AvGas for boosting octane performance to prevent engine knocking and protect valves. Without it, octane levels may be dangerously low, which could result in engine knocking, engine failure and complete internal destruction. The new FAA regulations therefore effectively render all engines that use AvGas defunct, and they open the door to a huge piston engine repower market for aircrafts and helicopters.

The repower market, is our “shotgun target”.

The fixed-wing (aircraft) piston aviation application presents a volume of sales of 2,500 engines per year, more than 95% are piston engines with a retail value in excess of $162.5 million. However, the new FAA mandate brings some changes to this general estimate. There are over 170,000 airplanes in the US fleet, and in the US alone, all piston engines currently using AvGas will now have to be replaced under the FAA mandate. This FAA mandate opens a one-time engine repower market, which, if we assume a 100% repower ratio, may exceed $11.05 billion in engine sales, or $5.5 billion if we assume 50% repower ratio of the total US fleet.

The fixed-wing (aircraft) piston aviation application presents a volume of sales of 2,500 engines per year, more than 95% are piston engines with a retail value in excess of $162.5 million. However, the new FAA mandate brings some changes to this general estimate. There are over 170,000 airplanes in the US fleet, and in the US alone, all piston engines currently using AvGas will now have to be replaced under the FAA mandate. This FAA mandate opens a one-time engine repower market, which, if we assume a 100% repower ratio, may exceed $11.05 billion in engine sales, or $5.5 billion if we assume 50% repower ratio of the total US fleet.

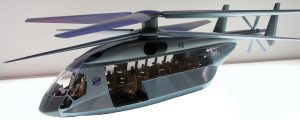

The rotary aviation application (civil helicopters only) presents a volume of sales of over 1,100 new engines per year, for power ratings from 250 HP to 750 HP (800 HP), and is valued at $165 million per year, based on the estimated wholesale price of $150,000 for a 700 HP Gryphon Diesel engine. The average cost of a new 600 HP turbine is over $400,000.

The current fleet of civilian helicopters worldwide comes to a total of about 28,000 units, with 46% in North America. 50% of this worldwide market could benefit immensely from repowering with Gryphon Diesel aviation engines, which may add an additional market of $2.1 billion.

A total of 30,000 military helicopters are operating worldwide, 34% in North America, with new sales of about 1,000 units per year. Most military helicopters, especially those operating outside North America, could also be equipped with Gryphon Diesel engines at a lower retail price, substantially lower operating cost and greater ease of maintenance.

Sales to military applications have not been included in our market evaluations.

LSA Market Potential

For engines operating at less than 150 HP, the volume of sales increases exponentially due to the LSA market, which is presently the largest growing aviation market worldwide and will likely continue to be for the next decade and after. Note that this market does not require engine certification, since it is deemed experimental by regulatory boards.

For engines operating at less than 150 HP, the volume of sales increases exponentially due to the LSA market, which is presently the largest growing aviation market worldwide and will likely continue to be for the next decade and after. Note that this market does not require engine certification, since it is deemed experimental by regulatory boards.

The LSA market is divided into three distinct sub-markets, and Gryphon Diesel Engines will only target the first two. The first tier is the upper end for engines with power ratings in the range of 70-135 HP, which has about 10,000 engine sales per year and is valued at over $180 million. The LSA sub-market for engines with mid-level power ratings of 35 HP -75 HP includes paramotors and parachutes such as ultralights, trikes, quads, microlights and power chutes. Their sales reach about 6,000 engines per year and are valued at over $20 million. In total, the annual sales for the top two tiers of the LSA market are valued at $200 million.

The first tier of the LSA market, is our “shotgun target”.

UAV Market Potential

Our overall worldwide UAV (drones) target market is the light to mid-size weight units for engines with ratings of up to 750 HP (800 HP). The UAV market is an emerging market whose overall worldwide sales were $6.7 billion in 2014 (including engines, airframes and systems), with about $100 million for engines alone. The UAV market is expected to grow exponentially and to expand to $10.5 billion by 2020.

Our overall worldwide UAV (drones) target market is the light to mid-size weight units for engines with ratings of up to 750 HP (800 HP). The UAV market is an emerging market whose overall worldwide sales were $6.7 billion in 2014 (including engines, airframes and systems), with about $100 million for engines alone. The UAV market is expected to grow exponentially and to expand to $10.5 billion by 2020.

It is a market which is custom oriented where engines are sought for particular applications.

Average wholesale estimated price for a 700 HP Gryphon Diesel engine is estimated to be $150,000 compared to over $400,000 for a 600 HP turbine.

Medium and Heavy Duty Cycle Trucks Market

We will first target the market for medium and heavy duty trucks, class 7 from 26,001 lbs. to 33,000 lbs. and class 8 from 33,001 lbs. to 80,000 lbs. This segment of the MHDC trucks engine market, is our “shotgun target”.

Eventually, we will reach class 6 through class 3, in that order.

But before we explore the market potential and our competition, it is important to outline the landscape of the trucking transportation industry, the problems it currently faces, and the ways in which Gryphon Diesel Engines might respond to them.

Truck transportation has reached a critical point of low profits. On average, truck fleets operate on a razor thin net profit margin of 1%-2%. Fuel is the top expense for truck fleets and it accounts for about 40% of overall expenses, with annual costs in Class 8 ranging from $70,000 to $125,000. In the United States, medium and heavy duty trucks use more than a quarter of all fuel burned annually. Driver’s salary is the second largest cost at 26%, repairs and maintenance is fourth at 10%.

Total Cost of Operation [TCO] is becoming more important to fleets in the face of rising fuel prices.

The trucking industry is enormous, and it already mostly uses diesel technology, but evermore environmental regulations will require some changes. Diesel powered trucks move approximately 90% of the US freight tonnage, and nearly all highway freight is diesel-powered, as are the majority of medium and heavy-duty trucks. There are about 3.5 million Class 8 trucks currently in operation, and about as many Class 7 trucks currently in operation in the US alone. Currently, 22% of all diesel trucks have the latest diesel technology (2010 and later). Emissions Phase One rules are now implemented; Phase Two will begin in 2021 and will go through 2027. The Environmental Protection Agency (EPA) is seeking uniformity of emissions performance for all 50 states. In addition, recently there has been a push from a coalition of agencies to lobby the EPA to require new trucks to emit “near-zero” emissions by January 2024. Although some engine powerplant projects are based on natural gas, the fact is that natural gas will secure only about 4% share of global transportation fuel mix by 2040, a slight increase from today’s 1%. So far, 0.02 grams of NOx emissions are achieved by few CNG fueled trucks under special conditions, i.e. very controlled ideal highway conditions, but not for normal day driving.

The trucking industry is enormous, and it already mostly uses diesel technology, but evermore environmental regulations will require some changes. Diesel powered trucks move approximately 90% of the US freight tonnage, and nearly all highway freight is diesel-powered, as are the majority of medium and heavy-duty trucks. There are about 3.5 million Class 8 trucks currently in operation, and about as many Class 7 trucks currently in operation in the US alone. Currently, 22% of all diesel trucks have the latest diesel technology (2010 and later). Emissions Phase One rules are now implemented; Phase Two will begin in 2021 and will go through 2027. The Environmental Protection Agency (EPA) is seeking uniformity of emissions performance for all 50 states. In addition, recently there has been a push from a coalition of agencies to lobby the EPA to require new trucks to emit “near-zero” emissions by January 2024. Although some engine powerplant projects are based on natural gas, the fact is that natural gas will secure only about 4% share of global transportation fuel mix by 2040, a slight increase from today’s 1%. So far, 0.02 grams of NOx emissions are achieved by few CNG fueled trucks under special conditions, i.e. very controlled ideal highway conditions, but not for normal day driving.

Unfortunately, complying with federal regulations has been costly due to expensive after-treatment solutions. Under EPA 04 rule, operating costs did not improve while fuel economy is just a little better. Engine surcharges approach $10,000 in addition to the surcharge of the EPA 04 rule. EPA 10 rule, effective January 2010, brought a third round of engine surcharges. In addition, Exhaust Gas Recirculation (EGR) deteriorated fuel economy more than engine manufacturers indicated. As a result of all this, trucks ordered today cost 45% more than those purchased before these EPA mandates.

The capacity to generate revenue that might make up for increasing operational costs comes from size of the fleet and shipping rates. 97% of truck fleets have 20 or less trucks and 90% have less than 6 trucks. Trucking companies collect $0.85 of every dollar spent on domestic freight transportation, with total revenue estimates at $255.5 billion. The average cost charged by fleets for transportation is $0.50 per pound for a full load. Still, the profit margin is minimal.

An average Class 8 truck operates about 110,000 miles per year, and a Class 7 truck about 55,000 miles. The best average fuel economy of a Class 8 truck, loaded to the federal limit of 80,000 lbs., is about 5 to 7 MPG on flat terrain, and about 2.9 MPG on a severe slope (>4% grade). The standard fuel tank capacity is about 100 gallons for an average range of 500 miles on flat terrain. The average daily run for an over-the-road truck driver is 500 miles. Federal regulation 11/14 rules applies to all truck drivers and it states that they cannot work more than 14 hours in a 24 hour period, and cannot drive more than 11 hours in a 24 hour period without taking a 10 hour break.

Additionally, the power density of Class 7 and 8 engines will actually increase significantly from 2014 to 2020 – some 6% to 8% – even as engines shrink in size from an average 14.1 liters displacement to about 13.7 liters. This will provide, in many cases, an opportunity for fleets “to have their cake and eat it too.” The upfront purchase price and total lifecycle costs of smaller engines tend to be lower, lighter weight, while fuel economy is a little better.

To respond to these dire problems, Gryphon Diesel Engines is offering smaller, lighter-weight hybrid powerplants with a lower upfront purchase price compared to competitors and lower total lifecycle costs as well as exceptional better fuel economy. Fuel savings using a hybrid engine system like ours, in addition to the added cargo permitted by the lighter weight engine, may make it possible to pay off a new truck within four months and significantly expand the net profit margin. Gryphon Diesel hybrid powerplants will manage to increase mileage to 35 MPG, 500%-600% more than current average or 20 to 25 MPG (300%) with optional Li-ion batteries, independent of terrain conditions and travel range of 3,500 miles without the need to refuel depending on type of battery used. This clearly helps mitigate the soaring fuel and operational costs that constantly plague this industry. Gryphon Diesel engines can provide “near-zero” emissions with 0.001 g/Km NOx, well beyond Tier 6, and very low noise during recharge mode (diesel engine operating), something a turbine is never capable to attain.

In addition, we will implement a Magnesium (Mg) battery rather than a Li-ion battery because Mg batteries recharge at a faster rate, can be done within the timeframe of a federally mandated stop or during down time, and can even recharge automatically while driving.

Hybrid engine operation allows to reduce fuel burn by 65% to 80%, depending on type of battery employed, while providing “zero idle” using energy only when needed (no idling), with zero noise and emissions. And it can extend the diesel engine life to >20,000 hours before engine overhaul.

The overall powertrain weight reduction we offer will open up space for up to 2,000 lbs. of cargo and may yield up to $30,000 more revenue each month.

Overall, there are many features of our hybrid diesel powerplants that will help address and offer real solutions to the difficult problems the trucking industry currently faces. With these superior improvements, Gryphon Diesel hybrid powerplants can bring a complete game change to the MHDC truck fleet in North America and worldwide by providing a substantial increase in net operating profits per truck. Our hybrid powerplants can substantially reduce shipping and distribution costs, and it may even be used as a deterrent against any upcoming inflation or hyperinflation situations, even if diesel costs exceeds well beyond $15 per gallon.

Market Potential

Overall annual US sales of medium and heavy duty trucks is about 370,000 units. By 2026 powertrain sales are expected to reach 820,000 per year. The wholesale value of these new engines sales (excluding transmission) is in excess of $9.25 billion, assuming the cost of the diesel engine at $25,000. The average retail cost of a new 500 HP diesel engine (excluding transmission) starts at about $28,000. If 50% of all 370,000 MHDC trucks are equipped with Gryphon Diesel hybrid powerplants, sales per year may exceed $18.5 billion, based on our price estimate of $100,000 for a hybrid powerplant system with 500 kWh battery pack.

To give some sales numbers for the different truck classes, the total sales of all classes of trucks per year in the US alone is nearly 700,000. The average number of trucks sold per year in the US alone, per class, are the following:

- Class 8 (33,001 lbs. – 80,000 lbs.):

- 180,000

- Class 7 (26,001 lbs. – 33,000 lbs.):

- 190,000

- Class 6 (19,501lbs. –26,000 lbs.):

- 52,000

- Class 5 (16,001lbs. –19,500 lbs.):

- 67,000

- Class 4 (14,001lbs. –16,000 lbs.):

- 13,000

- Class 3 (10,001 lbs. –14000 lbs.):

- 265,000

Additionally, the repower market for truck engines changing to a hybrid powertrain has the potential to exceed 100,000 trucks per year, at a value of $15 billion per year.

In terms of the global market, as economies grow, the truck population is expected to increase, and commercial and government fleet operators around the are pressed to consider investments in fuel efficiency technologies and alternative clean-burning fuels. Global commercial sales of alternative fuel powertrain MHDCs are expected to grow to 840,000 units per year by 2024. Additionally, ExxonMobil predicts that diesel will not only surpass gasoline as the number one global transportation fuel by 2020, but that diesel demand will account for 70% of the growth in demand for transportation fuels through 2040.

Truck and bus sales in Europe total about 310,000 units per year — 50% tractor trucks, 37% straight trucks and 10% of buses and 3% others. Trucks weighing less than 16 tons hold 20% of those sales and trucks weighing more than 16 tons hold 80%. South America has about 48 million trucks registered, 28 million in Brazil alone. Africa has 21 million, the Middle East has 26 million, Asia has 128 million (excluding Russia and China), and there are 58 million registered in Japan alone. Australia has about 12 million trucks registered. Norway is the highest consumer of electric vehicles in the European Community (EC), followed by the Netherlands, with Sweden and France trailing behind.

Gryphon Diesel will enter the MHDC market addressing pressing customer needs and therefore predicts securing the majority of the market. Our hybrid powerplant packages, which may include a 500 kWh battery, diesel engine and generator will have an estimated sale price of $100,000. Electric motors, software, and electronic two-speed transmission will be offered as optional items.

Power Generators and Non-Automotive Engines Market

Market Potential – Power Generators

Historically, the power generator market has been a multi-billion dollar market. It is currently valued at over $18.54 billion in retail sales per year worldwide. Diesel generator sales are expected to reach $23.26 billion in 2020. The Middle East and North Africa import the largest number of power generators globally at 29.1%, with countries such as the Saudi Arabia, UAE and Nigeria all providing lucrative markets for gensets with 60 KW capacity or higher. The UK is the world’s number one exporter of power generators, outperforming the US and China, having secured 19% of this market.

Historically, the power generator market has been a multi-billion dollar market. It is currently valued at over $18.54 billion in retail sales per year worldwide. Diesel generator sales are expected to reach $23.26 billion in 2020. The Middle East and North Africa import the largest number of power generators globally at 29.1%, with countries such as the Saudi Arabia, UAE and Nigeria all providing lucrative markets for gensets with 60 KW capacity or higher. The UK is the world’s number one exporter of power generators, outperforming the US and China, having secured 19% of this market.

Most small engines used in power generators that have a power output of up to 8 KW run on gasoline and are either two- or four-stroke engines. As such, there are currently no light-weight, low-noise, low-fuel consumption, and “green” diesel engines compliant with Tier 6 regulations and more, for power generators in production. We will therefore likely obtain a high percentage of the market share because our new product line will offer all of these very features. For example, our engine will demonstrate an initial 30% fuel reduction compared to current diesel generators and about 60% reduction compared to gasoline generators with the same KWe output. In addition, when considering the whole power generator system, not only the engine, our power generator offers a 30% weight reduction.

The Power Generator market segment of 60 KW or higher, is our “shotgun target”.

Market Potential – Non-Automotive Engines

Non-automotive applications, All-Terrain (ATV) and Off-Road Vehicles, account for about 30% of sales of all land-based diesel engines worldwide. Our design and its superior performance will bring a game change in this market.

Sales exceed 1 million vehicles per year with a gross value of $6 billion per year. More than 250,000 units are sold in the US alone. Polaris (32%), Honda (26%), Yamaha (17%), Artic Cat (10%), Can-Am (9%) have the most market share of the ATV sales. Textron and Deere & Co. have the most sales for the off-road market.

Based on the estimated $2,500 cost for a Gryphon Diesel single-piston engine, this ATV/Off-Road market represents about $2.5 billion in engine sales per year.

The ATV market segment of the Non-Automotive application is our “shotgun target”.

In sum, with these significant improvements in the industry, GRYPHON DIESEL ENGINES, LLC aims to achieve an exponential growth in sales on the order of millions of engines per year.